“eVTOL Shares Soar as Potential 2026 Take-off Allures Investors”

Phew! What an extraordinary last three months for eVTOL company stocks. What an exhilarating ride for investors.

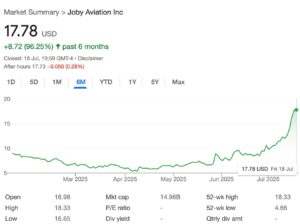

Take Joby Aviation. After President Trump’s global tariff threats during March and April, the U.S based company saw its share price plummet during the general stock market sell-off to a low of USD5.33 per share. Anyone brave enough to see the fall as merely temporary and jumped in at these lows… now just three months later, own a stock worth USD17.78 (July 18th) or a 233% increase on their investment. So that USD10,000 initially invested is now worth USD33,300. This dramatic rise has turned company Founder and CEO, JoeBen Bevirt, into a billionaire based on the number of shares he owns.

Not only Joby, but other eVTOL company stocks like Archer, Vertical Aerospace, EHang and others have benefited from a growing positive sentiment towards the industry. Even drone companies have been assisted by this wave of enthusiasm. Take Draganfly. Since early May, its share price has risen from a low of USD2.61 to USD7.49 (July 18th).

Joby Aviation share graph

Finally, five years after those SPAC flotations, followed by the usual stock market ups and downs, flying taxi investors can breathe a sigh of relief that not only is the industry being taken seriously, but the public seem keen to get involved with the impending green aviation revolution.

And what a ride it has been. For example, shareholders have experienced the trauma of seeing their EHang stock value drop like a stone from a dizzy height of USD124 beginning in early February 2021 to lows of around USD4 in October 2022; and worse still, Lilium holders had to endure the company being declared bankrupt in February, making their shares worthless. The stock market is not for the faint-hearted at the best of times.

So what has been the catalyst for this recent fervour?

Initially, it was President Trump who signed three Executive Orders last month “aimed at accelerating the development of advanced aviation technologies.” This includes eVTOLs and drones, where federal agencies have been directed to remove regulatory barriers as well as expand drone-related operations. Perhaps, ready to be commercially flown by the time of the FIFA World Cup in 2026 (to be shared by the U.S, Canada and Mexico), as well as the Los Angeles-based Olympics in 2028?

Please Watch Video

While the World Cup may come too soon, it is certain by 2028 flying taxis will be transporting people to the Olympic events. Already, Archer Aviation has been given the nod for its Midnight Aircraft to offer a primary service, but it is likely other U.S eVTOL companies like Joby and BETA Technologies may share this commercial venture.

What is driving President Trump is the desire to not only compete with China in this potentially massive new market, but beat them too. In the short term, that seems unlikely.

So, for investors it is time to hold on to your hats and see how the rest of the year fairs. On the economic front, the Trump administration claim tariffs have already yielded a burst of tax revenue which importers must pay when they bring targeted goods into the U.S. America recorded around USD27 billion in tariff-related tax revenue last month, alone, bringing total payments so far this year to more than USD100 billion, Treasury Department data shows.

Mark Zandi, Chief Economist at Moody’s Analytics, said, “Tariff revenue could exceed USD300 billion by the end of 2025, which would amount to nearly 1 percent of U.S gross domestic product.” That revenue could help ease government deficits, some suggest.

Meanwhile, the U.S economy has defied analysts’ fears of a large, tariff-induced price spike, while the inflation rate clocked in below the 3 percent recorded in January, the month President Trump took office. This has offered a feel good factor for the American economy with the hope of greater things to come, even though the country still labours under a USD37 trillion debt.

The present positive economic news may or may not prompt the Stock Market bulls to go all in, expecting higher rises in the U.S indices over the coming months. If so, the eVTOL sector is an obvious choice, where financial fundamentals have already flown out of the window and been replaced with sentiment and momentum, where technical analysts now rule the roost and charts and share graphs become king.

This is why some expect eVTOL stock values to continue rising, buoyed by ongoing news. For example, last Wednesday Joby released a press release that it is expanding manufacturing capacity at its California facility, while acquiring a 140-acre site at Dayton International Airport, Ohio. This facility, set to span 2 million sq. ft, will eventually be capable of producing up to 500 eVTOLs annually. This information thrust the share price higher by 17 percent.

At present, stockinvest.us suggest Joby shares may still have a way to climb. It writes on July 18th, “The stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. It has broken the rising trend up, which indicates an even stronger rate of rising. We conclude that the current level may hold a buying opportunity as there is a fair chance for Joby Aviation stock to perform well in the short-term period.”

The article ends, “We have upgraded our analysis conclusion for this stock since the last evaluation from a Hold/Accumulate to a Strong Buy candidate.”

https://stockinvest.us/stock/JOBY

Of course, do your own research, listen to your gut and take what the so-called experts say with a pinch of salt. Expect share movements to be volatile and erratic. But “IF” the Joby stock does continue to rise over the coming weeks, the other eVTOL shares may well ride on its coattails. On the other hand, if a long-term investor then all this noise and froth is meaningless to you.

Below is a list of related companies on the Stock Market along with their ticker symbol.

Surf Air Mobility (SRFM); Joby Aviation (Joby); Eve Air Mobility (EVEX); Archer Aviation (ACHR); EHang (EH); Vertical Aerospace (EVTL); Blade Air (BLDE); XTI Aerospace (XTIA); Volatus (VLTTF).

Meanwhile, expect other emerging eVTOL companies to float on the Stock Market. Perhaps, one of the more exciting prospects is XPeng Aeroht who has stated it may carry out an IPO at the end of this year. It is not certain whether the company will choose the Hong Kong or U.S Stock Exchange.

Of all the Chinese ones, this has to be the most appealing as it dwarfs EHang in stature. Supported by XPeng, one of the largest global automobile manufacturers, its extraordinary Land Aircraft Carrier Modular Flying Car is straight out of an Asimov novel. Then there is the Voyager X2, similar-looking to an EHang 216‑S. And what about TCab Tech who last week announced a stunning deal with Autocraft worth over USD1 billion. Will they be carrying out an IPO in the near future? Not forgetting AutoFlight, Aerofugia, Vertaxi, Volant Aerotech and Wanfeng who through a subsidiary, Diamond Aircraft Industries, bought Volocopter back in March.

XPeng Land Aircraft Carrier Modular Flying Car and Voyager X2 (Credit: XPeng Aeroht)

While it is possible to buy shares on the Chinese Exchanges this can be both complex and hazardous. It is best to focus on the U.S market where a number of Chinese companies list. EHang is a good example. The company can be found on NASDAQ. If a UK investor, various brokers have access to American exchanges including IG Index and Hargreaves Lansdown.

American poet and essayist, Walt Whitman, whimsically said, “The future is no more uncertain than the present.” And with two major wars raging; regular violence and demonstrations on the streets of America and Europe; rising global debt; and increasing climate ‘acts of god’; the global stock markets continue to show surprising resilience.

We have been promised that 2026 is the start of commercial green aviation flights, where the Middle East will forge the way alongside China. Unfortunately, the infrastructure required lags well behind the actual aircraft manufacturing. And while existing heliports can be used as initial locations, it may take some years for leading U.S pioneers like Joby and Archer to make money, where an annual profit remains a distant dream.

At present, this seems unimportant for stockholders. As prices continue to rise that urge to jump onboard increases, where common sense becomes blurred with not wanting to be left behind. No-one knows what may happen this week, let alone next month, but the eVTOL industry has turned a significant corner with its development progress and rising share prices are a sign that investors wish to be a part of this revolution.

(Top image: Joby Aviation)

For the latest news, insights and content regarding the global Advanced Air Mobility market, please join the following eVTOL Insights channels: WhatsApp, Facebook, Instagram, Spotify, Apple Podcasts, YouTube, X and LinkedIn.