EHang: Week of Warfare for Stock Market Gurus

What a conflicting week for EHang (EH) investors as stock market gurus went to war. It was the usual conflict between business fundamentals v share price momentum. The former closely scrutinises a company’s present intrinsic value, whereas the other throws caution to the wind and focuses on future potential and investor popularity.

That was the week that was for EHang.

Those in ring left, was led by experienced financial journalist, Louis Navellier. Described as “one of Wall Street’s renowned growth investors, who has provided investment advice to tens of thousands of investors for more than three decades”, his article, posted on investorplace.com and entitled “EHang Stock Could Be a Vehicle for High-Altitude Returns”, then subtitled, “EH stock could be your low-key bet on a potentially high-flying industry”, flew the flag for future potential.

Louis Navellier

He writes, “We’re giving the stock an “A” grade, not only for EHang’s progress in the flying car market, but because the company recently invested in next-generation battery technology… We encourage you to expand your horizons as a diversified investor.”

With a gentle dig at the fundamentalists, “When an industry is still in its early stages, it makes little sense to obsess over traditional valuation metrics,” while admitting that EHang “isn’t currently profitable”, he goes on, “Consider assigning a value based on the company’s potential future growth.”

Navellier then lists a series of recent positive company news including the five EH216 AAV units recently sold to Shenzhen Boeing Holdings Group alongside “a potential promise” of a further 95 in the future; that the Chinese CAAC has approved EHang’s Unmanned Aircraft Cloud System for trial flights; not forgetting, as the AAV company continually reminds investors, that its 216 aircraft is now over 95 percent towards gaining full certification, allowing commercial operations to begin. And then there is the latest news that EHang is closely involved in next-generation battery technology.

He points out, “EHang is ahead of the curve as the company recently announced a strategic investment in China-based Shenzhen Inx Technology, collaborating to develop solid-state lithium metal batteries.” And continues, “This savvy investment in AEV battery technology makes sense and could give EHang a notable competitive advantage in the long run.”

Signing of the EHang/Shenzhen Boeing Agreement (Credit: EHang)

Navellier concludes, “Therefore, regardless of traditional valuation metrics, EH stock looks undervalued and deserves a confident “A” grade. Before you know it, EHang might be a household name or at least a topic of conversation on Wall Street. ”

To add credence to his view, nasdaq.com then picked up on the article and posted it on their website, before then taking over the bugle fanfare.

Under the title “3 Flying Car Stocks That Can Double by the End of 2024”, EHang is firmly placed in the top 3 of the leading global eVTOL companies alongside Joby and Archer Aviation. The articles states, “The stock has witnessed a rally like Joby with an upside of 89 percent for year-to-date… EH is poised for multi-bagger returns.”

Like Navellier, the article lists a series of recent EHang accomplishments. In July, the company announced a USD23 million private placement funding by strategic investors… it has expanded test flights to Asia and Europe, completing 39,000 demonstrations and trial flights in 14 countries… with a big addressable market, the company seems positioned to boost its order book in the coming years.”

EHang’s Past 6 Months Share Price

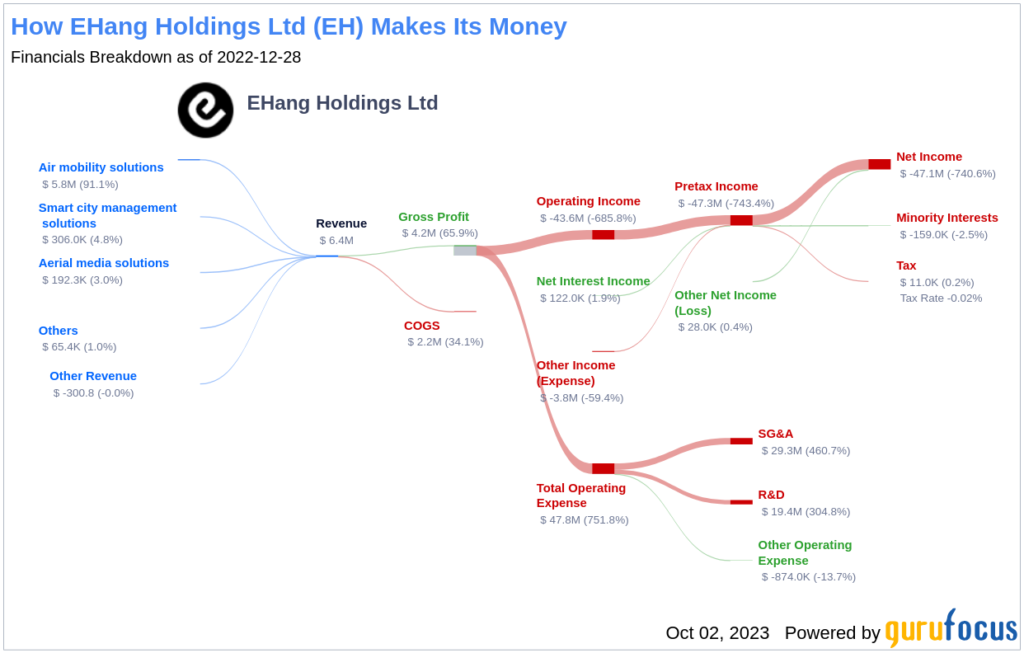

In ring right, the fundamentalists appear with a series of heavy punches to quash the left’s seemingly light-weight jabs. Led by gurufocus.com and supported from claytoncountyregister.com, it is no holds barred.

Under the title “EHang’s True Value: Is It Overpriced? An In-Depth Exploration”, then subtitled, “Unraveling the intrinsic value of EHang using GuruFocus’s (GF) proprietary valuation model,” the website means business.

It begins, “At its current price, EHang has a market cap of USD1.10 billion. The stock appears to be significantly overvalued when compared to our estimated fair value of USD8.37.” GF brazenly boasts of its “exclusive method” to derive this stock value, using historical ratio multiples, past returns and growth alongside future estimates of business performance.

Based on this, “the stock appears to be significantly overvalued. This suggests that the long-term return of EHang’s stock is likely to be much lower than its future business growth.”

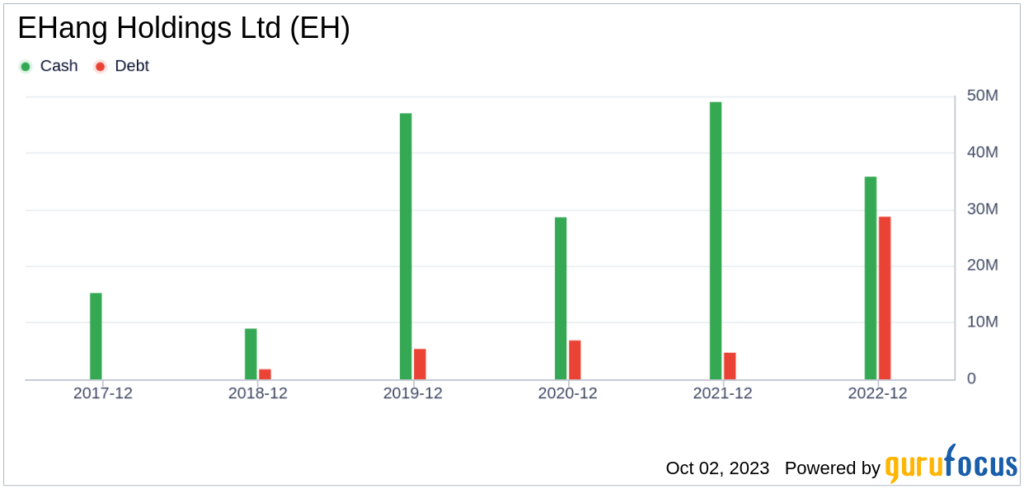

Even so, the website grudgingly admits, “EHang has a cash-to-debt ratio of 0.9, which is better than 53.74% of 294 companies in the Aerospace & Defense industry. GuruFocus ranks the overall financial strength of the company at 5 out of 10, indicating that its financial strength is fair.”

Yet immediately jabs, “EHang Holdings has been profitable 0 over the past 10 years. Over the past twelve months, the company had a revenue of USD8 million and Loss Per Share of USD0.85. Its operating margins is ‑562.41%, which ranks worse than 96.95% of 295 companies in the Aerospace & Defense industry. Overall, the profitability of EHang is ranked 1 out of 10, indicating poor profitability.”

Ouch!

After all the initial positive views, gurufocus places the knock out punch and investors wake up with a headache befitting a night of drunken debauchery.

But does all this “exclusive proprietary valuation model” really mean much? Investing in a stock market share that is leading the green aviation revolution is also about supporting a better world. Of course, EHang is not making a profit, but might it be in five years time? Yes, the eVTOL industry is risky, very risky, but if you want to place your money in dull blue-chip companies like the utility sector, for example, so be it. Everyone believed banks were “blue-chip certs” until 2008 struck.

Of course, a balanced portfolio is essential, but surely an occasional flutter is required to keep boredom away from the door? gurufocus continues its heavy hitting by concluding, “The company’s financial condition is fair and its profitability is poor. Its growth ranks worse than 93.1% of 232 companies in the Aerospace & Defense industry.” How important is this? Obviously, don’t invest your house on EHang, but a flutter to experience the spills and thrills is, perhaps, one way of looking at the company?

It is possible that when the world views the Volocity flying at the Paris Olympic Games in 10 months time, coupled with Archer’s first U.S commercial foray the following year, eVTOL shares could become the new dotcom bubble? The excitement of seeing these flying aircraft may generate a frenzy of share buying, yet no-one wants the next share price boom and bust as EHang experienced back in February, 2021.

While, common sense must prevail, everyone should enjoy an occasional flutter… surely?

For more information

(Top image: EHang 216 AAV)