KPMG Air Taxi Readiness Index 2022

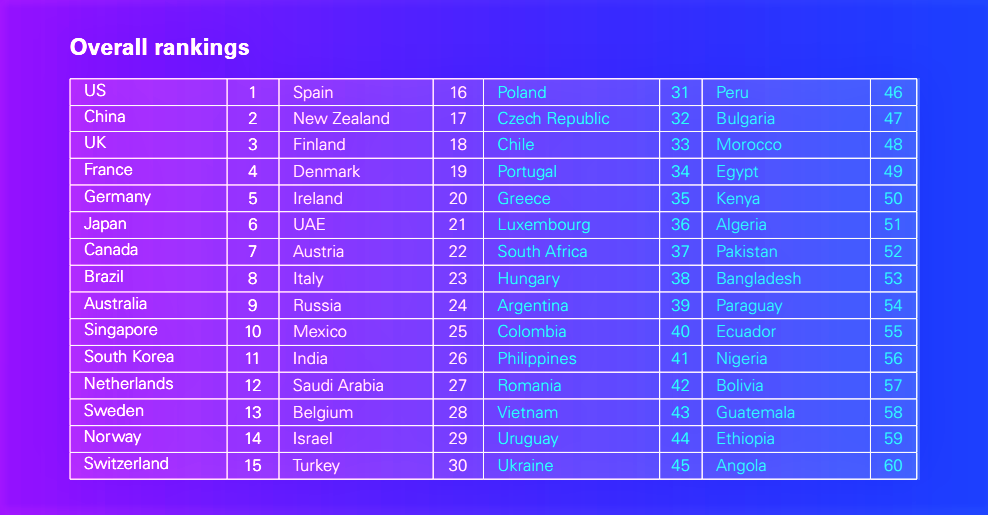

KPMG is assessing the preparedness of 60 territories in advanced air mobility (AAM) with its air taxi readiness index (ATRI), a tool to facilitate discussion on the level of preparedness for the upcoming generation of passenger-carrying Short or Vertical Take-off and Landing (S/VTOL) vehicles.

It is a composite index that combines over 47 individual existing metrics from a range of sources into a single score: consumer acceptance, infrastructure, policy and legislation, technology and innovation, and business opportunity.

In terms of consumer acceptance, the US leads as in 2021, with China in second place, and Singapore and Brazil in third and fourth. As for infrastructure, the US has moved to the top with China down to second, followed by South Korea, UAE and Japan to make up the top five.

With regards to policy and legislation, the top spot is taken by the UK, with the US coming second, while third, fourth, and fifth slots are taken by Denmark, Canada and the Netherlands.

The US remains the clear leader in technology and innovation, whilst the Netherlands and Singapore are replaced in second and third spots by China and the UK, respectively, with Japan and Brazil completing the top five. Business opportunity is dominated by the US again, followed by the UK, France, Canada and Germany.

The US has the highest air traffic volume of any country in the index, indicating strong consumer demand for air travel, as well as a highly developed air traffic control infrastructure, which should form a sound basis for AAM regulation.

The US FAA has this year announced changes to its certification pathway for fixed-wing eVTOL aircraft, which will now be certified as ‘powered lift’ aircraft rather than small plane. In addition, the FAA has released draft guidelines for vertiport design.

China jumps from 6th to 2nd place this year, coming second in consumer acceptance, infrastructure, and technology and innovation, and remains especially dominant in market size, ride hailing and taxi market penetration, air traffic quantity and skyscraper density.

Its modest performances in policy and legislation can be accounted for by its data-sharing environment and transparency, whilst the business opportunity score is depressed by low net national income – clearly an example where China’s scale and urban vs. rural contrasts mean that affordability will differ widely by province.

The UK is ranked third overall, up 1 place from 2021, with strong performances across policy and legislation, business opportunity, and consumer acceptance. The relatively low score for infrastructure is largely accounted for by broadband and mobile connection speeds.

The UK is the overall leader in policy and legislation, reflecting mature regulatory functions and significant government investment. Operators, aircraft manufacturers, air traffic management, physical assets and infrastructure providers are encouraged to work together to create viable and sustainable concepts of operation (ConOps). The UK’s Civil Aviation Authority (CAA) is also adopting European Aviation Safety Agency (EASA) certification for next-generation eVTOL aircraft.

Brazil comes in at 8th, a significant improvement of 17 places on its 2021 ranking, driven largely by the addition of business opportunity to the index, which takes greater account of Brazil’s scale and depth as a potential air taxi adopter.

Ireland’s strongest performance is in consumer acceptance, with infrastructure and business opportunity being its weakest, due to factors like low national population density, and a modest helicopter market today.

India ranks relatively consistent performances with one of its strongest individual metrics being its potential market size.

Belgium sits mid-table, similar to 2021, scoring relatively highly for technology and innovation, but below par for infrastructure. Nonetheless, Belgium enjoys features that still have the potential to play into its air taxi readiness.

Israel’s highest performance this year is in policy and legislation and its lowest in business opportunity, with a vibrant unmanned aircraft and drone industry with a large number of companies developing technologies and products in the advanced air mobility ecosystem, including a number of aircraft OEMs currently working on eVTOL concepts.

Poland sits mid-table with its worst performance, as in 2021, in technology and innovation, and its highest in consumer acceptance. Overall there is remarkable consistency in its scores.